Understanding the Beneficial Ownership Information Reporting Rule: FAQ’s For Business Owners

Posted on December 8, 2023 by Mark Nuelle

As part of efforts to curb money laundering, increase transparency of business ownership and to reduce other financial crimes, FinCEN has issued a new rule requiring businesses to report the personal identifiable information of their owners.

This is known as beneficial ownership reporting. To comply with this rule, businesses must understand who their beneficial owners are, and provide their names, addresses, and other personal information to FinCEN. Failure to comply with this rule could result in significant fines and reputational damage. Therefore, it is important for businesses to take this requirement seriously and ensure they have the necessary systems in place to report their beneficial ownership information accurately and in a timely manner.

The Corporate Transparency Act CTA has been in place for some time now and is part of the Anti-Money Laundering Act of 2020. Recently, the U.S. Treasury Department’s bureau, FinCEN, issued a final rule on the beneficial ownership reporting requirements. This is a significant step towards ensuring a safer and more secure financial system for all.

Who Will This Impact?

Starting January 1, 2024, non-exempt corporations, limited liability companies, and other similar entities will be subject to the BOI Reporting Rule, which mandates that they report identifying information about the beneficial owners who own or control the reporting company as well as the company applicants who form or register them. Additionally, once effective, reporting companies created on or after that date must report information on their beneficial ownership (BOI) and company applicants within 30 days of their formation, while companies formed or registered prior to January 1, 2024, will have until January 1, 2025, to file their initial reports.

As per SEC regulations, a beneficial owner is someone who directly or indirectly exercises substantial control over a company or owns or controls 25% or more of a company’s ownership interests. This is a crucial aspect of corporate governance that helps prevent financial crimes such as money laundering and terrorism financing. At times, beneficial ownership can be difficult to determine, but it is important for companies to keep track of it in order to maintain transparency and comply with regulatory requirements.

What information is needed when reporting?

As per the guidelines set by the Financial Action Task Force FATF, companies need to provide comprehensive information in their beneficial ownership reports. The report should include the names, addresses, and other relevant identification details of all the individuals who own or control the company. Companies should also provide details of the ownership structure, including the percentage of shares or voting rights held by each individual. The report should be regularly updated to reflect any changes in ownership or control. The company must also submit an image of the identification document to FinCEN.

What are the deadlines?

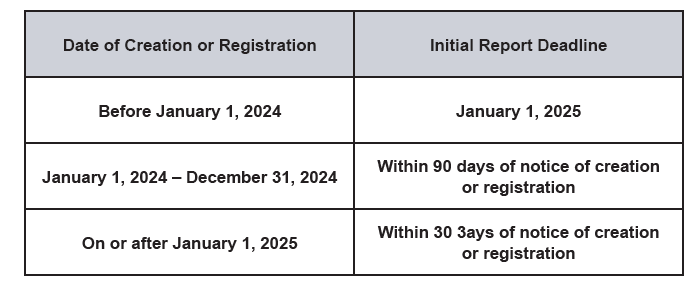

Initial reporting deadlines depend on the date of an entity’s creation or registration to do business in the United States. Following a November 30, 2023 amendment Final Reporting Rule, those deadlines are as follows:

Are There Penalties of Non-Compliance?

The Beneficial Ownership Rule requires companies to report information about the individuals who own or control the business. Failure to comply with this reporting requirement can result in harsh penalties. Any company that fails to file a beneficial ownership report or amendment by its deadline is subject to a fine of $500 per day, up to a maximum of $10,000. These penalties can quickly add up, making it essential for companies to stay on top of their reporting obligations. Therefore, it is crucial for businesses to ensure that they are compliant with the Beneficial Ownership Rule and avoid the costly consequences of noncompliance.

How Will Beneficial Ownership Reporting Take Place?

If you are a company that needs to report beneficial ownership information to FinCEN, you can do so easily and securely through FinCEN’s website. This electronic filing system is designed to simplify the process and ensure that your information is submitted accurately and efficiently. Rest assured that your information is kept confidential and secure, and that you are doing your part to protect the integrity of the financial system.

Where can I go with additional questions?

If you’re unsure about how the FinCEN beneficial ownership information ruling affects your business, you’re not alone. The good news is that there are resources available to help you navigate this important regulation. First and foremost, you can turn to the FinCEN website, which provides detailed information about the ruling and its requirements. Additionally, you can reach out to your local B2B CFO Partner for guidance and support. Don’t hesitate to seek out expert advice to ensure that your business is in compliance with this regulation.

Business Owner Resources:

FinCen.gov: https://www.fincen.gov/boi-faqs

Federal Register: https://www.federalregister.gov/documents/2023/11/08/2023-24559/use-of-fincen-identifiers-for-reporting-beneficial-ownership-information-of-entities

US Department of Treasury:

https://home.treasury.gov/news/press-releases/jy0633

Money Laundering Watch:

https://www.moneylaunderingnews.com/category/beneficial-ownersh