Download: Where does Cash Go?

Chapter 6 of the Danger Zone

Improve Cash Flow

A company must have sufficient cash to operate to continue in business

The lack of cash can kill a company quicker than any direct competitor.

Improving and managing cash flow is a discipline. Ideally, the control over cash flow is a process within a company and not vested with any one single person.

Companies are typically good at identifying certain departments that are key to the business, such as sales, operations, production, etc.

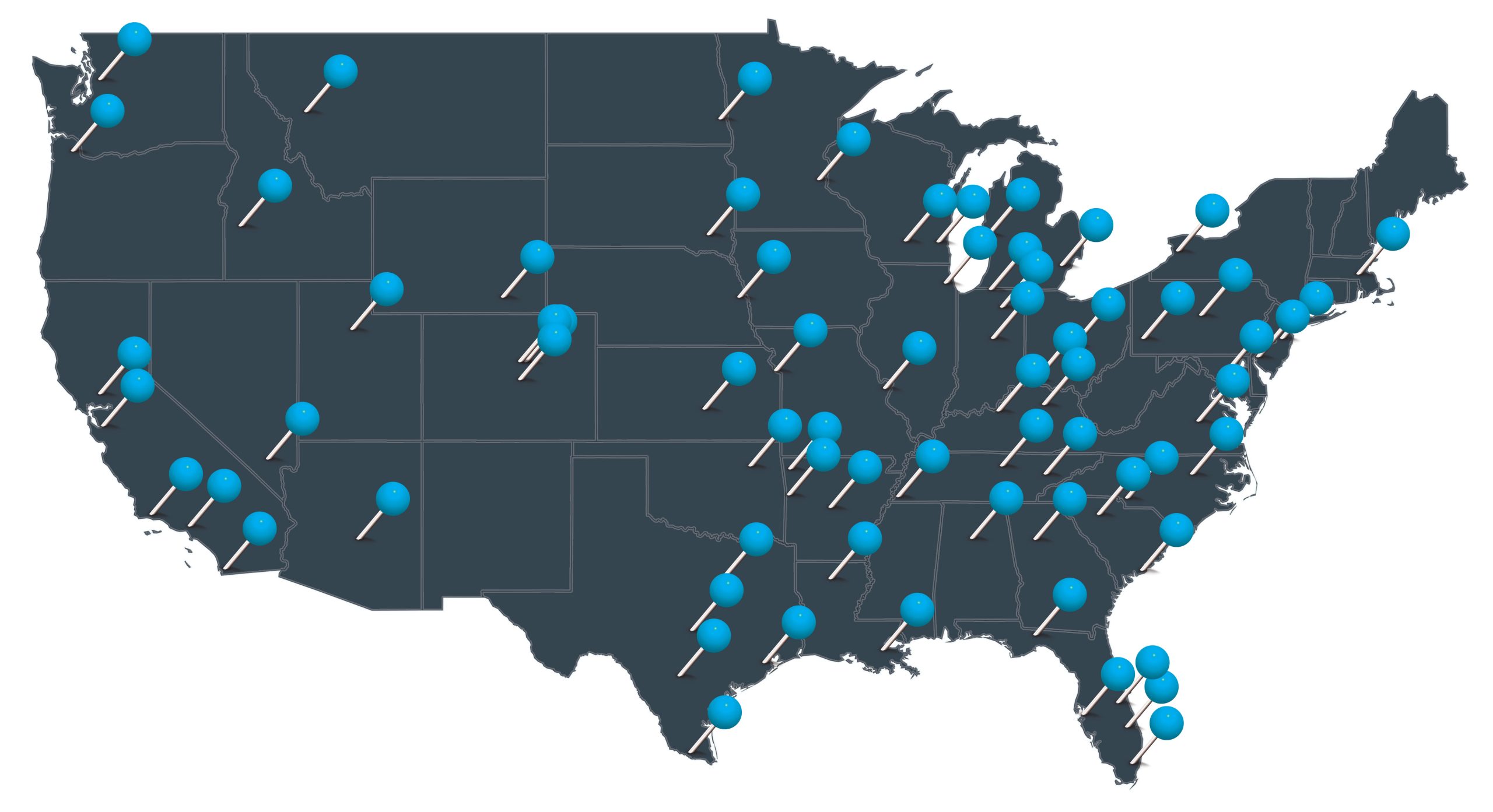

The management of cash flow should be viewed as a separate department within a company. That department needs to have a responsible person that can guide and teach others. Most important, this department must communicate possible cash shortages to management many months in advance. This department should take all information from all other departments (sales, purchasing, etc.) and forecast the future sources and uses of cash.

Improving cash flow requires the discipline of looking into the future. This future view should include all factors that impact a company’s cash.

The Wall Street Journal (WSJ) and Random House, Inc. approached B2B CFO® in 2008 with an idea, which was to write a book to help business owners related to the topic of improving cash flow. Both entities used the B2B CFO® process in their book, The Wall Street Journal, Complete Small Business Guidebook.

The WSJ book states, “… the chart on page 90 shows ABC Company’s operating cash, beginning with January and outlines its estimated sales and expenses through July. You’ll see the benefit of making such a chart when you look at the month of April, which shows a deficit. Assuming this business owner prepared cash flow projections in January, he or she now has four months to come up with a plan for surviving the projected shortfall.” (pp. 90-91.)