Download: Bankers and Lenders - Friend or Foe?

Chapter 15 of the Danger Zone

Obtain Bank Loans

Most privately held companies need lending.

Loans are needed for operations, growth, expansion, equipment purchases, the purchase of buildings and a host of other purposes.

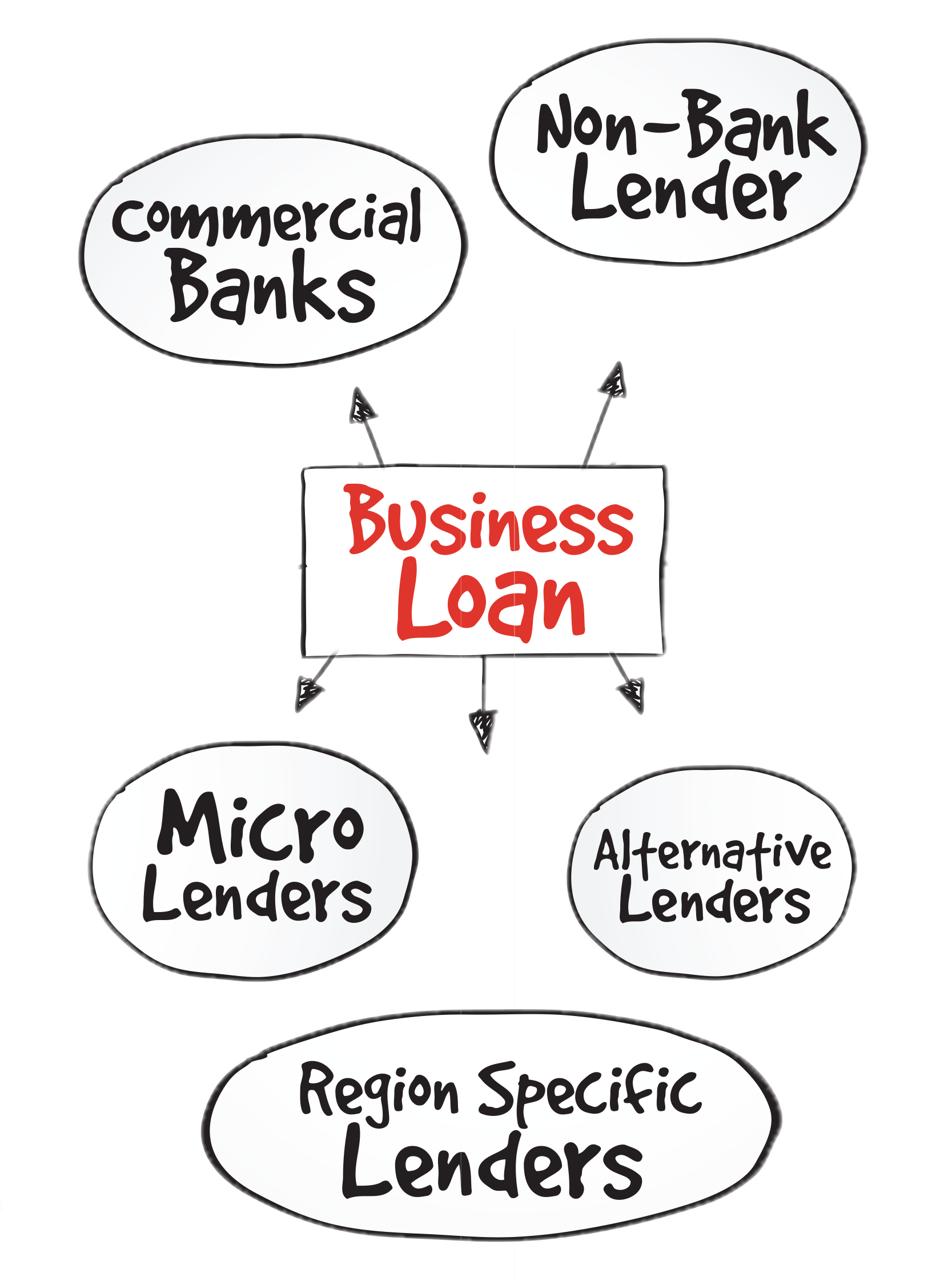

One of the largest sources of lending to privately held companies is from banks. These banks can be large retail banks or smaller community banks.

A complexity of asking for business loans is that not all the banks are the same with their lending practices. Some restrict bank lending in certain industries deemed to be risky.

Small Business Association (SBA) loans can be very frustrating to owners of privately held companies.

This annoyance is often compounded by an unrealistic view of the public related to loans “guaranteed” by the federal government. The SBA does not guarantee 100% of a business loan. While it is true the SBA may guarantee a high percentage (say, 80%) of a business loan, no bank wants to take a risk of losing 20% of any loan. The purpose of a bank is to make money and any loan write-off hits the bottom line of their Income Statement.

It is rare today that banks will loan money to privately held companies unless they meet a certain minimum criterion, such as:

- Detailed documentation on future free cash flows (FCF).

- Internal financial statements that are accurate and timely.

- The company’s KPIs (Key Performance Indicators) are within a reasonable percentage of its industry KPIs.

- A description of the collateral that adequately protects the bank.

- A solid management team that gives the bank comfort that the future performance of the company will be adequate to pay the new debt service.

- Evidence that important ratios (Current, Debt-to-Equity, etc.) are within industry averages and/or meet loan covenants.

- A comfort level that certain financial loan covenants documented in the note payable can be achieved by the company.

- Etc.